05 May 2015

Over the past year our renewable energy team at bto has seen an upsurge in the number of our clients seeking advice on hydro developments across Scotland. The advice being sought ranges from property aspects to construction aspects and constitutional advice. By way of a general update, the following themes have emerged and are worthy of consideration:

Degression

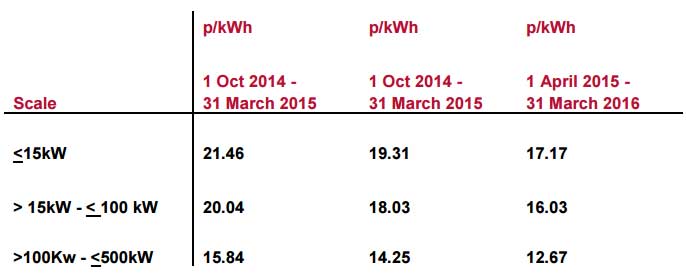

Given that the number of hydro schemes that were commissioned in 2014 has exceeded 50.1MW, the maximum 20% degression has been applied across all bands of the feed in tariff from 1 April 2015. This reflects the increase we have seen in hydro developments. The before and after rates are:

The April 2015 figures are inclusive of 1.6% RPI increase. Despite the comparatively high degression being applied to the feed in tariff rates for hydro, our clients are continuing to make significant investment in hydro projects.

FiT CfD – Offering certainty to investors

On 26 February 2015, the Department of Energy and Climate Change announced the names of 27 renewables energy projects, which were awarded contracts worth a total of more than £315 million, following the first allocation round under the new Contracts for Difference (CfD) program.

CfDs are set to replace the Renewables Obligation (which will close to new projects from 1 April 2017) as a key incentive for the development of major renewables projects. It will offer a fixed price for generators supplying energy, known as a strike price – if the sale price is less than the strike price, the generator will receive a top up payment, if it is more, the generator will pay back the difference. This will create a certainty of returns for investors while affording protection to consumers by way of a claw-back.

Amongst the requirements for eligibility are the need for (i) valid planning permissions and (ii) an accepted grid connection offer. If the requirements are met, generators wishing to join, must compete for CfDs in an ‘auction’. If successful, the generator will be asked to enter into a 15 year contract with the Low Carbon Contracts Company. Where an offer is made, and the generator does not sign the contract, they cannot apply in another round for the same site for 13 months.

Those that have been awarded and timeously returned their signed contracts in the first round will have 1 year to secure their finance. The next allocation round is due to take place in October 2015, with the budget for this round to be announced later this year.

Structuring

As the mainstream funding market for small scale hydro schemes remains limited, we have seen a number of alternative structures being used in order to get developments off the ground. In particular, we have been involved in a number of joint ventures between landowners and developers as an alternative to the classic model of the developer simply taking a turnover based lease of the relevant site from a landowner.

We are continuing to see a desire from community groups to be involved in hydro schemes both as a minor stakeholder and as primary developers. The availability of CARES funding is helping enable such groups to participate in projects that would otherwise be out of their reach.

Property Issues

We regularly see the same property issues coming up in hydro schemes that are worth bearing in mind. Where funding for a hydro scheme is being obtained from an external source (typically a bank or investor), borrowings are usually secured against the land needed for the scheme or in cases where the developer has taken a long lease of the required land, the lender will take a security over the Lease. It is essential that the Lease contains not only rights for the developer to install and operate the scheme but also rights and obligations that make the Lease “bankable”.

As obvious as it may seem, we continue to see projects where the necessary water rights have not been secured. Consideration must be given to any involvement that might be needed from third parties. Lenders will not only be looking to ensure that the usual consents and licences are in place but also in cases where the developer does not have control of the whole of the watercourse between the abstraction point to the point at which the water is returned, that the developer has obtained the consent of proprietors of the riverbank between these points and has considered any adverse impact the scheme may have on third parties who draw water from the river. Consideration should also be given to the catchment area of the river and the flow of water to the scheme to ensure that the flow is protected. Redevelopment or change of use to surrounding land may have an impact on the quantity and/or quality of water to the scheme. The law relating to water rights in Scotland is different to that in England. Our dual qualified solicitors are always on hand to explain the differences in particular to England based developers and funders.

Key Contacts:

|

|

|

Nicolas McBride |

Scott Wyper |